How Much Car Loan Can I Afford Malaysia

Check out the below table to determine how much car you can. Well walk you through the key steps.

Malaysia Ringgit Loan Cash Loans Finance Loans

Here is how your total interest monthly.

. The rule states that the total operating cost of a car should fall between 10 and 15 of your annual income. Calculator to Determine Eligibility for a Car Loan Earnings on a monthly basis. Use this calculator to enter the monthly payment you are able to make.

Earn at least an income of Rs. Theres no perfect formula for how much you can afford but our short answer is that your new-car payment should be no more than 15 of your monthly take-home pay. Though they generally have a high monthly income requirement their.

Because its recommended you spend no more than 10 to 15 of your monthly after-tax income on your car payment your monthly payment will significantly. Auto Financing Affordability Calculator Looking to buy a new car. The calculator here will help you find the amount you can spend on a car based.

You only need at least RM1800 monthly income which is one of the lowest income requirements you can find in Malaysia. To find how much car you can afford you need to first calculate the amount you can pay as your car loan emi. 10 down payment 35-year tenure 35 interest rate buyer spends 30 of monthly salary on home loan.

NerdWallet recommends spending no more than 10 of your take-home pay on your monthly. Use our calculator to find out the estimated financing amount for your car. Use your monthly budget to estimate your maximum car price with our car affordability calculator.

Calculate the car payment you can afford. Your Affordability Per Month RM Payment Period. Normally you need to make some payment in advance when buying a car but the amount varies.

How Much Car Can I Afford. Calculator The car we want is not always the car we can afford. Projected vehicle-related expenses Knowing how much auto loan you can afford means first taking into consideration what the loan will cost including any down payment that you will be.

Adjust down payment trade-in value loan term and APR to see how. Lets circle back to the same example where your car loan is at RM70000 with an interest rate of 35 percent and a five-year loan period. You can ask your bank about the rebate amount.

The bare minimum should be 10000 dollars. Earn at least Rs. 180000 annually including the income of your spouseCo-applicant.

The length of time in.

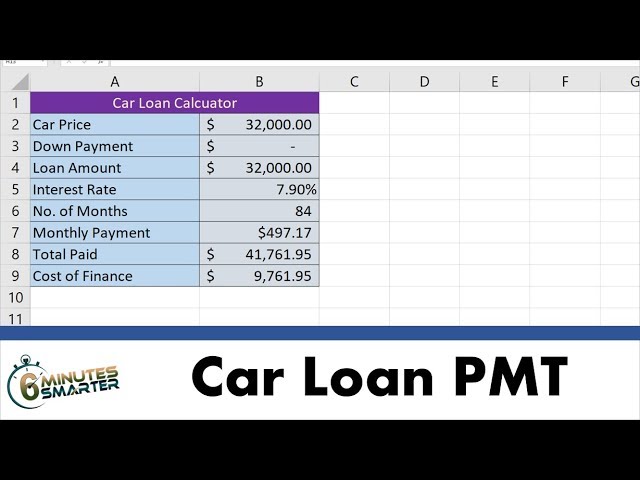

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

How Do I Qualify For A Car Loan Experian

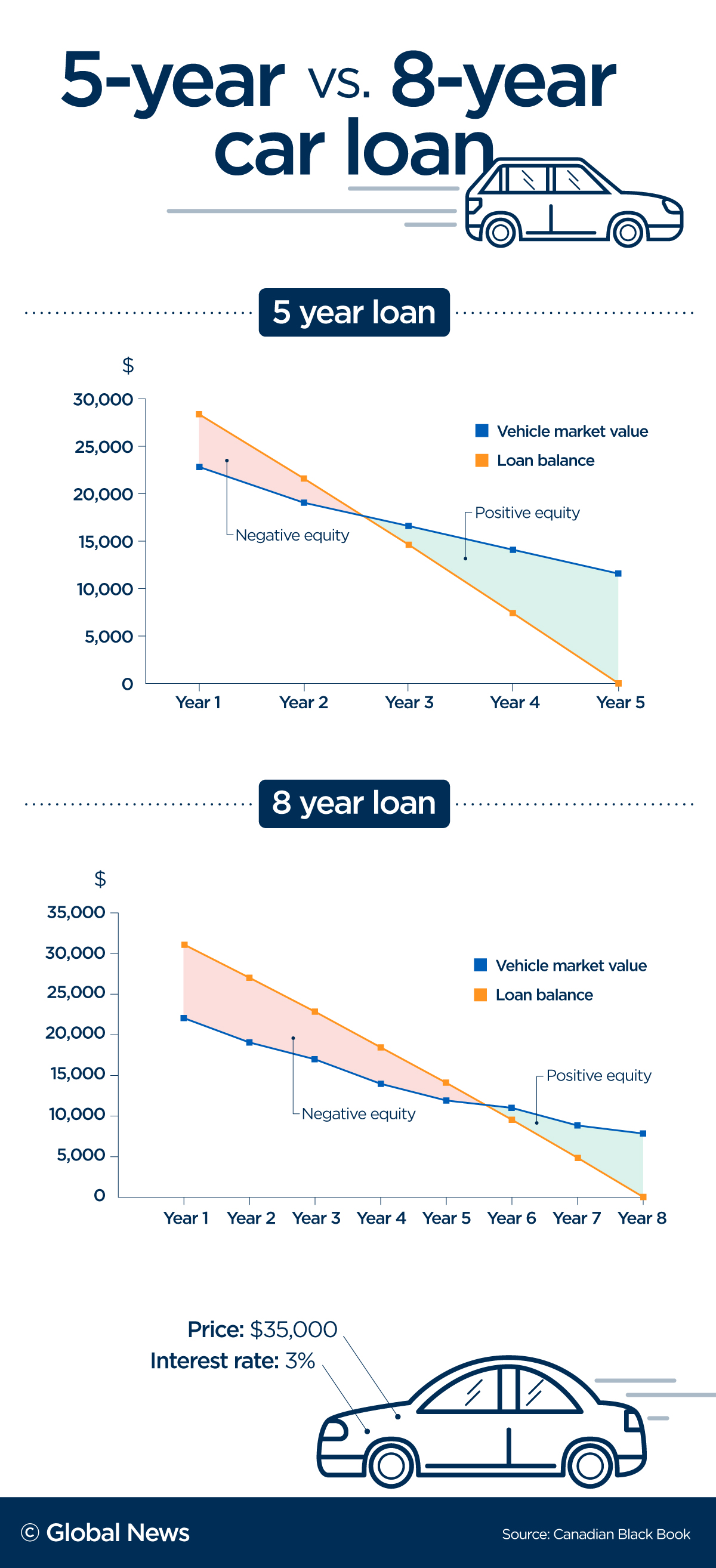

Your Car Loan Payment May Be Way Too High Here S What S Happening National Globalnews Ca

What Car Can You Really Afford With Rm 5 000 Monthly Salary

Infographic The Essential Guide To Driving In Makati Moneymax Philippines First Time Driver Makati Infographic

Nordstrom Employee Portal Login Help You In Managing Your Payroll Data Employee Login Portal

Comments

Post a Comment